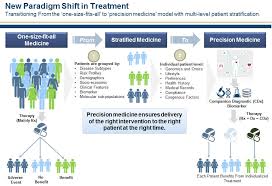

The rise of personalized medicine is revolutionizing the healthcare sector, driving health insurance providers to adapt their approaches to coverage and risk management. Personalized medicine, which uses genetic, environmental, and lifestyle information to tailor medical treatments, presents both opportunities and challenges for insurers. This article delves into how health insurance providers are responding to this transformative trend, focusing on the integration of genetic data, adjustments in coverage plans, enhanced risk management, and evolving customer engagement strategies.

Integration of Genetic Data

The incorporation of genetic data into health insurance is one of the most profound changes brought about by personalized medicine. Health insurance providers are increasingly leveraging genetic information to develop more precise and personalized coverage plans. This integration allows insurers to assess individual health risks with greater accuracy, moving beyond generic risk models. For example, by using genetic profiles, insurers can identify predispositions to certain diseases and offer tailored preventive measures or treatments.

The shift towards personalized plans not only enhances the effectiveness of health management but also aligns with a more proactive approach to healthcare. Insurers are investing in technologies that facilitate the integration of genetic data into their systems, enabling them to offer policies that are closely aligned with individual health needs. This move is expected to improve health outcomes by providing targeted interventions and reducing the incidence of preventable conditions.

Adjustments in Coverage Plans

As personalized medicine gains traction, health insurance providers are re-evaluating and adjusting their coverage plans. Traditional insurance models often lack the flexibility to accommodate the nuanced needs of individuals undergoing personalized treatments. To address this, insurers are expanding their coverage to include innovative therapies and targeted medications that are not typically covered under standard plans.

These adjustments are crucial for ensuring that patients have access to the latest advancements in personalized medicine without facing financial constraints. For instance, coverage might now extend to genetic testing and personalized drug therapies that were previously considered experimental or out of reach. By offering such comprehensive coverage, insurers are positioning themselves to meet the demands of a rapidly evolving healthcare landscape.

Enhanced Risk Management

The rise of personalized medicine has prompted health insurers to adopt new risk management strategies. Traditional risk assessment models are often inadequate for the complexities introduced by genetic data and individualized treatments. To address this, insurers are investing in advanced analytics and predictive modeling techniques.

These technologies enable insurers to better understand and manage the risks associated with personalized medicine. By analyzing vast amounts of genetic and health data, insurers can develop more accurate risk profiles and tailor their strategies accordingly. This proactive approach helps in mitigating potential financial impacts and ensuring the sustainability of insurance models in the face of rising healthcare costs associated with personalized treatments.

Customer Engagement and Education

With the increasing prevalence of personalized medicine, health insurance providers are placing a greater emphasis on customer engagement and education. As policyholders encounter new and complex information related to their genetic profiles, insurers recognize the need to support and guide them through these changes.

Insurers are developing resources and tools to help individuals understand their genetic information and its implications for their insurance coverage. This includes offering access to genetic counselors and educational materials that explain the benefits and limitations of personalized medicine. By fostering a deeper understanding among policyholders, insurers aim to empower them to make informed decisions about their health and insurance options.

Moreover, effective customer engagement strategies are crucial for building trust and ensuring that policyholders feel supported throughout their healthcare journey. Insurers are adopting digital platforms and interactive tools to facilitate communication and provide personalized support, enhancing the overall customer experience.

Future Directions and Innovations

Looking ahead, the integration of personalized medicine into health insurance is expected to drive further innovations. Insurers are exploring new technologies and collaborative approaches to enhance their offerings. For instance, the use of artificial intelligence (AI) and machine learning is becoming increasingly common in risk assessment and customer service. These technologies enable insurers to analyze complex data sets, predict health trends, and offer more personalized solutions.

Additionally, there is a growing emphasis on collaboration between insurers and healthcare providers. By working together, insurers and providers can ensure that personalized treatments are seamlessly integrated into insurance plans and that patients receive coordinated care. This collaborative approach is essential for addressing the challenges of personalized medicine and maximizing its benefits for patients.

In conclusion, the rise of personalized medicine is significantly reshaping the health insurance industry. Providers are adapting by integrating genetic data, adjusting coverage plans, enhancing risk management, and focusing on customer engagement. As personalized medicine continues to evolve, insurers must remain agile and innovative to meet the needs of their policyholders and ensure effective, sustainable coverage.

To read more articles like this click here.

To read more about such topics click here.