In recent years, mental health coverage has become a critical focus within health insurance policies. As awareness of mental health issues grows, individuals and families increasingly seek comprehensive mental health benefits from their insurance providers. This article delves into the evolving landscape of mental health coverage, examining how health insurance policies address mental health needs, the impact on policyholders, and what to look for when selecting coverage.

The Growing Importance of Mental Health Coverage

Mental health coverage is no longer a secondary consideration but a primary component of health insurance policies. With rising awareness about mental health conditions, including anxiety, depression, and bipolar disorder, there is a greater emphasis on integrating mental health services into health insurance plans. The importance of mental health coverage is evident as more people recognize that mental health is as crucial as physical health in overall well-being. This shift reflects a broader societal change towards valuing mental health and acknowledging its role in a person’s quality of life.

Key Features of Mental Health Coverage

When evaluating health insurance policies, it is essential to understand the key features of mental health coverage. Policies typically include benefits such as therapy sessions, psychiatric consultations, and medication management. Coverage may extend to various types of mental health professionals, including psychologists, psychiatrists, and licensed counselors. Additionally, some policies offer access to telehealth services, which can be particularly beneficial for those seeking remote support. Telehealth has become increasingly popular, offering flexibility and accessibility for individuals who may not have local access to mental health providers.

Moreover, many policies are now including coverage for innovative treatments and therapies, such as cognitive-behavioral therapy (CBT), mindfulness-based stress reduction (MBSR), and other evidence-based approaches. This expansion reflects an understanding that mental health care is diverse and that different conditions may require different treatment modalities.

Understanding Policy Limits and Exclusions

While mental health coverage is increasingly comprehensive, it is crucial to be aware of policy limits and exclusions. Health insurance plans often have caps on the number of therapy sessions or psychiatric visits covered annually. Some policies may exclude certain types of mental health treatments or require higher out-of-pocket costs for specific services. Reviewing the details of coverage limits and exclusions can help individuals make informed decisions about their mental health care.

In addition to session limits, policies might also impose restrictions on the types of conditions covered. For instance, some plans may offer extensive coverage for conditions like depression but limit support for more severe or less common disorders. Understanding these nuances can prevent unexpected expenses and ensure that the chosen plan meets specific needs.

The Impact of Mental Health Parity Laws

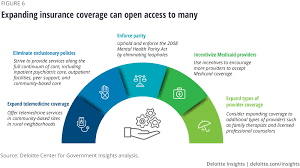

Mental health parity laws have significantly influenced the extent of mental health coverage in insurance policies. These laws require that mental health benefits be comparable to physical health benefits, eliminating discrimination against mental health care. The implementation of these laws has led to more equitable coverage, ensuring that mental health services are not subject to more stringent limitations than those for physical health conditions.

Mental health parity has led to substantial improvements in coverage, such as eliminating higher copayments or stricter limits on mental health services compared to physical health services. However, while progress has been made, challenges remain in ensuring full compliance with parity regulations. Ongoing advocacy and awareness efforts are necessary to address gaps and ensure that mental health coverage is truly equivalent to physical health coverage.

Tips for Selecting the Right Mental Health Coverage

Choosing the right health insurance policy for mental health coverage involves careful consideration of several factors. Evaluate the range of mental health services covered, including the types of professionals and treatment options. Consider the policy’s network of mental health providers and whether it includes convenient access to telehealth services. Additionally, assess the policy’s cost structure, including premiums, copayments, and deductibles, to ensure that it fits within your budget while meeting your mental health needs.

Another important factor to consider is the quality of mental health services provided by the insurance plan. Research whether the plan covers well-regarded therapists and clinics, and read reviews or seek recommendations from others. Ensuring that the insurance policy aligns with personal preferences and values can enhance the effectiveness of mental health treatment and overall satisfaction with the plan.

Conclusion

Mental health coverage in health insurance policies has evolved significantly, reflecting a growing recognition of the importance of mental well-being. Understanding the key features of mental health coverage, being aware of policy limits and exclusions, and recognizing the impact of mental health parity laws are crucial for making informed decisions. By carefully evaluating these aspects and selecting a plan that meets individual needs, individuals can ensure that they receive comprehensive support for their mental health. As mental health continues to gain prominence, insurance policies will likely continue to adapt, offering enhanced coverage and support for those seeking mental health care.

To read more articles like this click here.

To read more about such topics click here.