In the age of health tech innovations, navigating health insurance options has become increasingly complex yet promising. The focus keyword, “health tech innovations,” encapsulates the transformative impact technology is having on the insurance landscape. As digital health tools and data analytics evolve, they present new opportunities and challenges for both insurers and policyholders. Understanding these advancements is crucial for making informed decisions about health coverage.

Understanding Health Tech Innovations

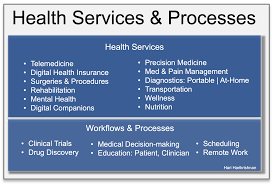

Health tech innovations are reshaping how health insurance operates, providing a range of new tools and technologies that enhance both patient care and insurance management. From telemedicine and wearable health devices to AI-driven analytics, these technologies are not only improving health outcomes but also affecting insurance premiums and coverage options. This dynamic shift requires consumers to stay informed about how these innovations might influence their insurance choices and costs. By leveraging these advancements, insurers can offer more tailored plans that better meet individual needs, but navigating these new options can be challenging without a clear understanding of how they work.

The Rise of Telemedicine and Virtual Care

Telemedicine has become a cornerstone of modern healthcare, particularly during the COVID-19 pandemic. This technology allows patients to consult with healthcare providers remotely, offering convenience and reducing the need for in-person visits. Insurance companies are increasingly incorporating telemedicine services into their plans, which can lower out-of-pocket costs for patients and offer more flexible care options. However, navigating these new offerings requires understanding what is covered and how it impacts overall insurance costs. Patients should check if their insurance plan includes telemedicine benefits, and if so, what types of services are covered and any limitations that may apply. As telemedicine becomes more integrated into health insurance, staying informed about the coverage and potential costs will be crucial for managing healthcare expenses effectively.

Wearable Devices and Health Data Integration

Wearable devices, such as fitness trackers and smartwatches, are providing insurers with real-time health data. This integration of health data into insurance models allows for more personalized insurance plans and potentially lower premiums for individuals who maintain healthy lifestyles. Wearables can track various health metrics, such as physical activity, heart rate, and sleep patterns, providing valuable data that can be used to assess health risks and adjust insurance coverage accordingly. However, this also raises concerns about privacy and data security. Policyholders need to be aware of how their health data is being used, what measures are in place to protect their privacy, and how this information might influence their insurance premiums and coverage options. Understanding these aspects can help consumers make more informed decisions about their health insurance.

AI and Machine Learning in Risk Assessment

Artificial Intelligence (AI) and machine learning are revolutionizing risk assessment in health insurance. These technologies analyze vast amounts of data to predict health risks more accurately and tailor insurance plans accordingly. AI can help insurers offer more customized coverage options and potentially lower premiums for individuals based on their health data and lifestyle choices. For example, AI algorithms can identify patterns in health data that indicate higher or lower risk, allowing insurers to adjust premiums based on individual risk profiles. This personalized approach can lead to more equitable pricing and better coverage options for consumers. However, it is essential to understand how these algorithms work and what factors they consider when assessing risk. Transparency in AI-driven decision-making processes is crucial for ensuring fairness and accuracy in insurance pricing and coverage.

Navigating the Complexities of Health Insurance

With the integration of these health tech innovations, navigating health insurance options has become more complex. Consumers need to evaluate not only the traditional aspects of insurance plans but also how new technologies might affect their coverage and costs. Staying informed about the latest advancements and understanding their implications can help individuals make more educated decisions about their health insurance. It is important to review plan details carefully, consider how technology impacts coverage options, and seek guidance from insurance experts if needed. By being proactive and knowledgeable, consumers can better manage their health insurance and optimize their coverage in this evolving landscape.

The Future of Health Insurance and Technology

Looking ahead, the integration of health tech innovations is expected to continue shaping the future of health insurance. As technology advances, new tools and approaches will emerge, offering even more personalized and efficient insurance solutions. For example, advances in genomics and personalized medicine may lead to more tailored insurance plans that reflect individual genetic risk factors. Similarly, innovations in artificial intelligence and data analytics will likely provide even deeper insights into health risks and insurance needs. Staying informed about these trends and understanding how they might impact health insurance options will be essential for navigating the future of healthcare coverage effectively.By keeping abreast of health tech innovations and understanding their effects on health insurance, individuals can make better decisions and optimize their coverage options in this rapidly evolving landscape.

To read more articles like this click here.

To read more about such topics click here.